통합 검색

통합 검색

- 작성자 관리자

- 조회수 68

Future Outlook for Semaglutide and Novo Nordisk's Market Position

1. Market Growth Acceleration Through Expanded Indications

Proven Efficacy in Kidney Disease Treatment

The FLOW study results, published in May 2024, demonstrated that a 1.0mg dose of semaglutide reduces the risk of cardiovascular events by 18% and mortality by 20%. This positions semaglutide as a promising treatment option for the 800 million patients worldwide suffering from chronic kidney disease (CKD), significantly expanding its market potential[citation:User News1].

Potential in Alcohol Use Disorder (AUD) Treatment

A February 2025 clinical trial revealed that semaglutide reduced alcohol consumption by 40% over nine weeks. This breakthrough suggests a new therapeutic application for GLP-1 receptor agonists, offering a more accessible and effective treatment compared to existing options, which could drive additional demand[citation:User News2].

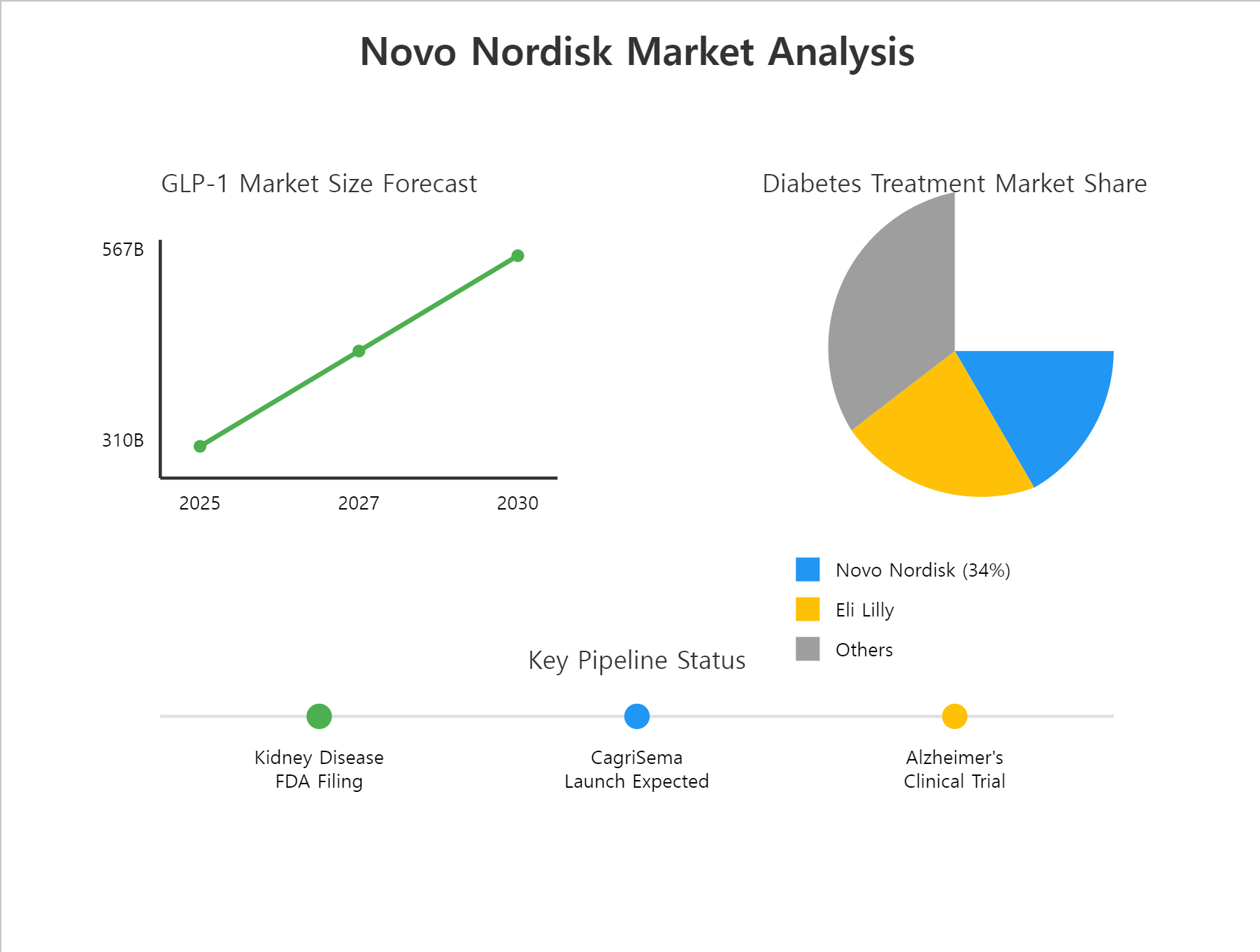

Ongoing Alzheimer’s Disease Trials

The EVOKE trials are currently evaluating semaglutide’s potential to improve cognitive function. Success in this area could elevate semaglutide to blockbuster status, further solidifying its market dominance.

2. Factors Sustaining Novo Nordisk’s Market Leadership

Enhanced R&D and Production Capabilities

In November 2023, Novo Nordisk invested $6 billion to expand its Danish production facilities, addressing the surging demand for Ozempic and Wegovy. This move ensures supply chain stability and strengthens its market share.

Innovative Pipeline Products

CagriSema, a combination of semaglutide and cagrilintide, is slated for launch in 2026. With a 22.7% weight reduction efficacy, it is expected to outperform competitors and maintain Novo Nordisk’s competitive edge.

Growing Global Demand for Obesity and Diabetes Treatments

With over 4 billion people projected to be overweight or obese by 2035, the increasing demand in North America and the Asia-Pacific region will drive Novo Nordisk’s growth.

3. Competitive Advantages Over Rivals

Superior Efficacy Compared to Competitors

While Eli Lilly’s Zepbound (tirzepatide) showed a 47% higher weight loss efficacy than Wegovy, Novo Nordisk’s CagriSema maintains a competitive 22.7% efficacy, ensuring its market relevance.

Diversified Product Portfolio

Novo Nordisk offers a range of administration methods, including oral Rybelsus and injectable Ozempic/Wegovy, maximizing patient accessibility. As of 2023, the company holds a 34% market share in the injectable diabetes treatment market.

Regulatory Approvals and Insurance Coverage Expansion

Novo Nordisk plans to submit applications to the FDA and EMA by the end of 2024 to expand semaglutide’s indications to include CKD, opening up new market opportunities[citation:User News1].

4. Potential Risks and Mitigation Strategies

High Price Barrier

Semaglutide’s high annual treatment cost (approximately $13,000) could hinder market penetration in emerging economies. Novo Nordisk is addressing this through production optimization and insurance negotiations to improve accessibility.

Intensifying Competition

Competitors like Eli Lilly, BMS, and Pfizer are accelerating the development of GLP-1-based therapies. However, Novo Nordisk’s 85 years of expertise and technological advancements provide a strong foundation to maintain its competitive edge.

5. Outlook and Conclusion

Market Size Projections

The global market for GLP-1 receptor agonists is expected to grow from $31 billion in 2025 to $56.7 billion by 2030, with obesity treatments driving the highest growth.

Novo Nordisk’s Continued Growth

Wegovy and Zepbound are projected to rank first and second in global sales by 2028. Novo Nordisk’s strategic investments in new indications and AI-driven production optimization will further enhance profitability.

Comprehensive Assessment

Semaglutide’s multifaceted therapeutic benefits and Novo Nordisk’s strategic initiatives position the company for long-term market leadership. However, sustained R&D investment and competitive pricing will be critical to maintaining this advantage.

댓글 0