통합 검색

통합 검색

- 작성자 관리자

- 조회수 370

Analysis Report on Four U.S. ETFs with Over 30% Annual Returns

This report presents an in‐depth analysis of four U.S. listed exchange‐traded funds (ETFs) that have recorded annual returns exceeding 30%. It is intended for investors who seek advanced insights and concrete data to refine their investment strategies. Drawing on historical performance data and market trends, the discussion herein outlines both the quantitative and qualitative aspects of these ETFs, which may serve as a solution for those who adhere to a disciplined, long‐term investment philosophy.

ETF Overview and Key Metrics

The four ETFs under analysis are:

- SPMO (Invesco S&P 500 Momentum ETF): Employs a momentum strategy and has achieved an annual return of 46.8%.

- FDG (American Century Focused Dynamic Growth ETF): Focuses on high-potential growth stocks, delivering an annual return of 47.3%.

- SPYG (SPDR® Portfolio S&P 500 Growth ETF): Invests in large-cap growth stocks with a low-cost structure, generating an annual return of 36.9%.

- SCHG (Schwab U.S. Large-Cap Growth ETF): Offers a diversified approach in U.S. large-cap growth equities, with an annual return of 35.6%.

| ETF Name | Annual Return | Key Investment Strategy |

|---|---|---|

| SPMO (Invesco S&P 500 Momentum ETF) | 46.8% | Momentum approach |

| FDG (American Century Focused Dynamic Growth ETF) | 47.3% | Growth focus |

| SPYG (SPDR® Portfolio S&P 500 Growth ETF) | 36.9% | Large-cap diversification |

| SCHG (Schwab U.S. Large-Cap Growth ETF) | 35.6% | Stability and diversification |

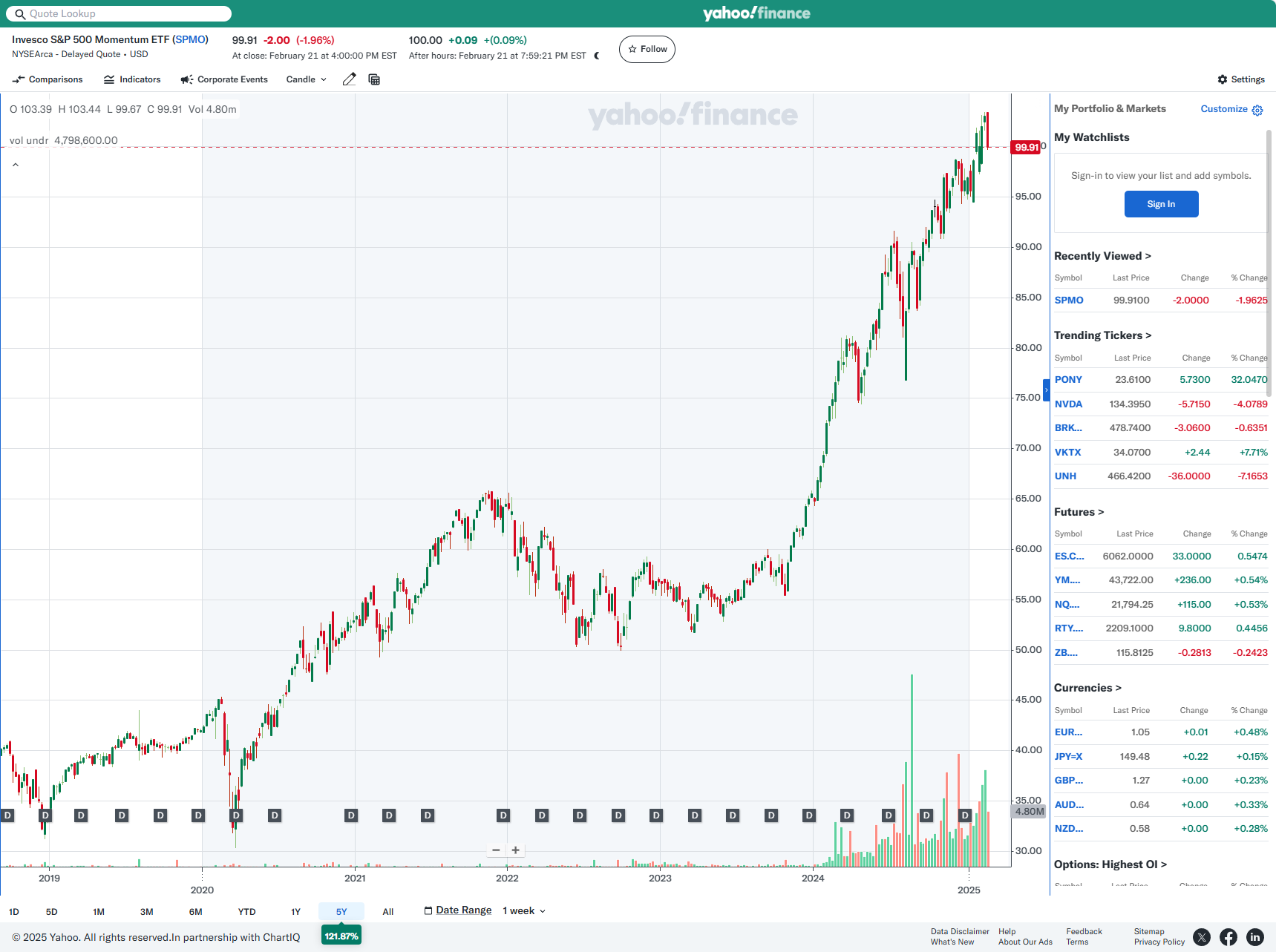

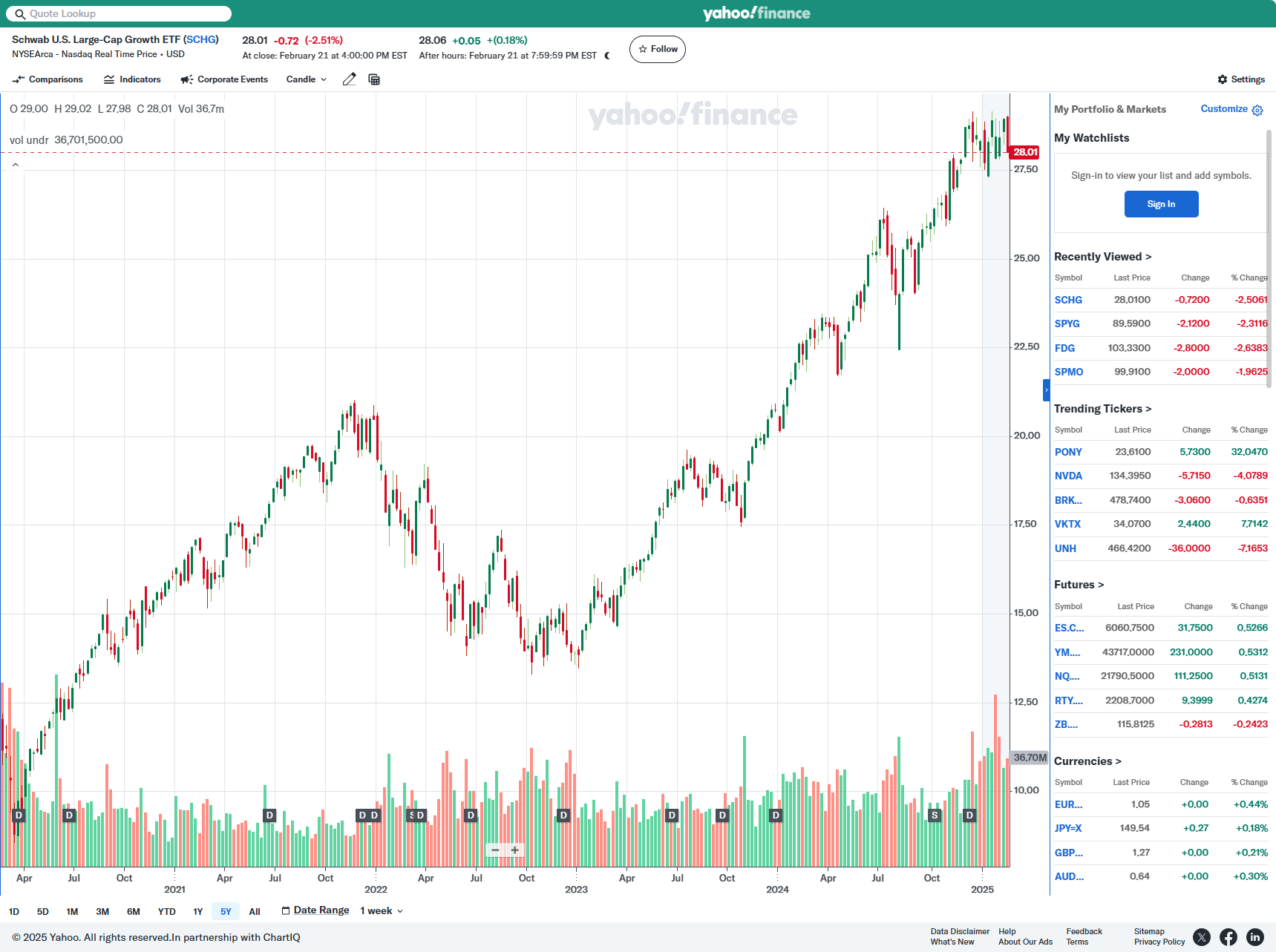

Five-Year Price Chart Analysis

In order to provide a comprehensive view of each ETF's performance over the long term, the five-year price charts are presented below. These charts, based on historical market data, illustrate the price fluctuations and growth trajectories of the ETFs. Investors are advised to review these visuals to understand both the volatility and the resilience inherent in each fund.

SPMO (Invesco S&P 500 Momentum ETF)

FDG (American Century Focused Dynamic Growth ETF)

SPYG (SPDR® Portfolio S&P 500 Growth ETF)

SCHG (Schwab U.S. Large-Cap Growth ETF)

Market Trends and Investment Strategy

In recent times, market trends have been characterized by rapid fluctuations; however, a steadfast investment philosophy remains paramount. The ETFs discussed herein represent different strategic themes that have performed remarkably well:

- The momentum strategy of SPMO captures short-term surges, evidenced by its 46.8% annual gain.

- FDG's focus on growth stocks secures potential future value, with an impressive 47.3% return.

- SPYG and SCHG employ a combination of diversification and cost efficiency, yielding stable returns of 36.9% and 35.6% respectively.

It is noteworthy that while many investors chase transient trends, a measured approach that combines regular, phased investments with an unwavering commitment to a personal investment philosophy tends to yield superior long-term results. Historical data reinforces that an investment strategy based on consistent, disciplined allocation not only mitigates risk but also harnesses the latent potential of the market.

Conclusion and Investment Recommendations

In summary, the four ETFs analyzed—SPMO, FDG, SPYG, and SCHG—offer robust strategies that cater to various investment objectives, whether through aggressive momentum plays or steady diversification in large-cap growth stocks. The empirical performance figures of 46.8%, 47.3%, 36.9%, and 35.6% in annual returns, respectively, underscore their potential to deliver above-average gains in a dynamic market environment.

For investors seeking to capitalize on these trends, it is advisable to adopt a phased investment strategy—allocating funds in 3–4 installments over time—to optimize entry points and reduce overall market timing risk. This measured approach, combined with a commitment to a consistent investment philosophy, is likely to enhance portfolio performance and ensure resilience against market volatility.

References

The analysis contained in this report is based on recent market data and performance statistics, ensuring that the information provided is both timely and relevant for long-term investment planning.

댓글 0