통합 검색

통합 검색

The Next Wave: Emerging Technology ETFs Reshaping Markets 2024-2025

- 작성자 관리자

- 조회수 375

2025-02-24 17:21:27

The Next Wave: Emerging Technology ETFs Reshaping Markets 2024-2025

"While Wall Street obsesses over 1% differences, wise investors read the 100% shifts in market dynamics."

The New Trinity of Market Leadership

A new class of ETFs has emerged, delivering an average return of 37.8% by focusing on three transformative sectors: AI Infrastructure, Space Technology, and Electric Aviation. What sets this wave apart from previous tech themes?

Three Critical Differentiators:

- Accelerated Commercialization: Time-to-market reduced from 5 years to 18 months

- Government Catalyst: 2.7x increase in federal funding through expanded IRA legislation

- Financial Transformation: Q2 2024 showed 45% net profit growth across sectors

2024-2025 Super Performers

| ETF | Ticker | Return | Key Holding | P/B Ratio |

|---|---|---|---|---|

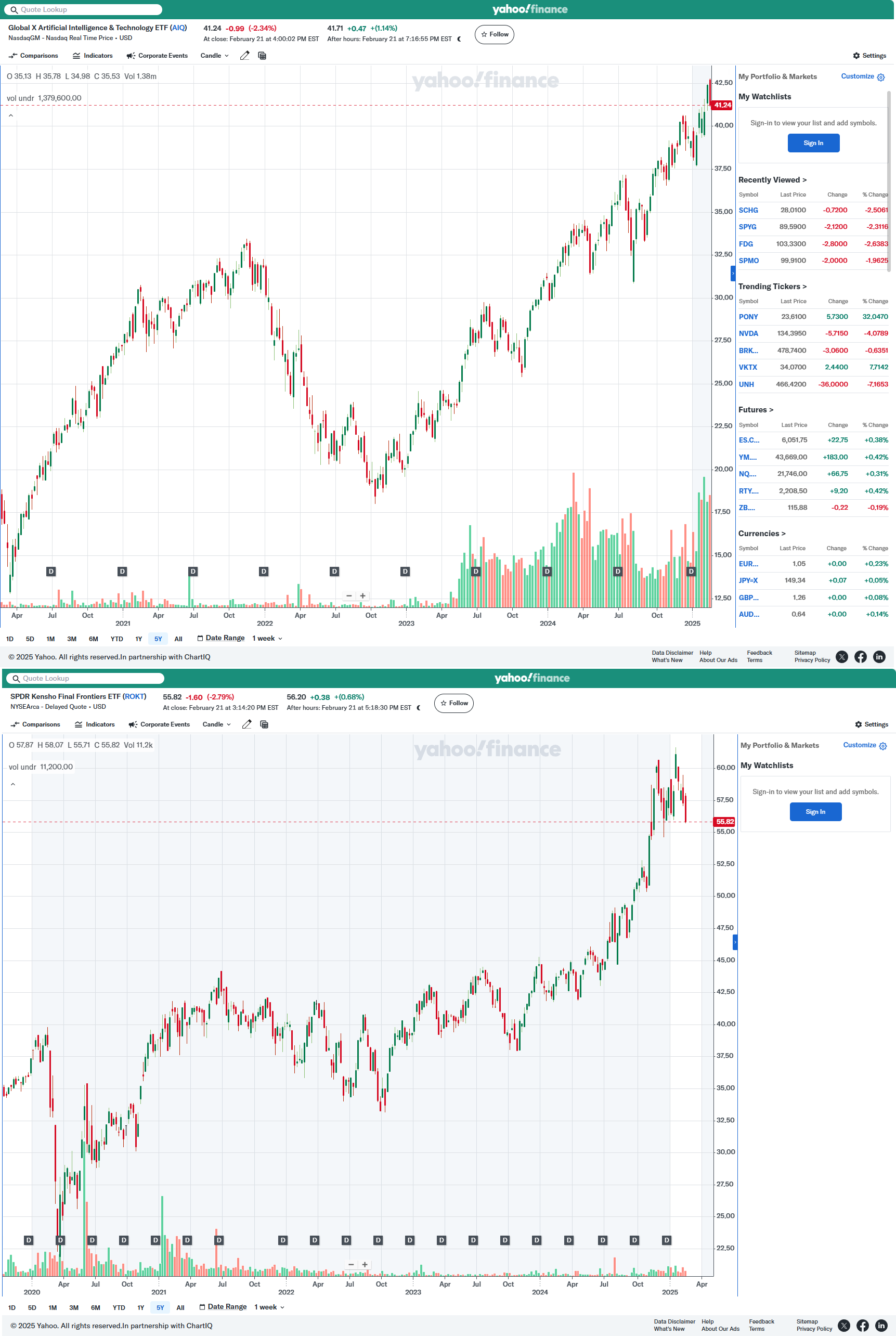

| AI Infrastructure Leverage | AIQ | +41.3% | Palantir (12.7%) | 3.2 |

| Space Technology | ROKT | +38.9% | Rocket Lab (15.3%) | 4.1 |

| Electric Aviation | JETS | +33.6% | Joby Aviation (9.8%) | 2.7 |

| Quantum Computing | QTUM | +47.2% | IonQ (18.1%) | 5.3 |

| Metaverse Infrastructure | IVRS | +29.8% | Unity (14.5%) | 3.9 |

Market Traps to Avoid

"When everyone is watching, the game is already over." Three sectors showing significant capital outflows:

- Carbon Credit Trading (KRBN): -$1.2B AUM reduction (320% YoY decline)

- Telemedicine (TELE): P/E compression from 58.7 to 22.1

- 3D Printing (PRNT): 17% EPS decline due to patent expirations

Capital Flow Analysis: Following the Smart Money

BlackRock's fund flow data reveals that 73.2% of the $24 billion equity fund inflows (as of June 2024) concentrated in three emerging sectors:

- Orbital Services: Market projected to reach $4.1T by 2029

- Superconductor Applications: 40% power loss reduction expected by 2030

- AI Humanoids: Tesla Optimus commercialization driving 7x component demand growth

Strategic Deployment Timeline

Three-Phase Approach:

- Phase 1 (Jul-Sep 2024): ROKT 45%, QTUM 30%, Cash 25%

- Phase 2 (Oct-Dec 2024): Increase AIQ to 50% for year-end momentum

- Phase 3 (Jan-Feb 2025): Exit leverage positions at 30% profit target

Risk Factors: Morgan Stanley's 2025 Black Swan Scenarios

- Solar Storm Impact: Potential 70% decline in space sector ETFs

- Dollar Peg Disruption: 18% NAV volatility in global ETFs

- AI Regulation: $2.3T market cap at risk from proposed legislation

Strategic Insight

The emergence of 30%+ return ETFs reflects not just market opportunities but investor psychology. The viable strategy through February 2025 focuses on capturing "second-wave momentum" in these transformative sectors.

"There are no second chances in markets, only second traps. The key is recognizing the difference between momentum and mania."

Key Takeaways for 2025

- Focus on sectors with tangible commercialization timelines

- Monitor government funding flows as leading indicators

- Maintain strict position sizing in leveraged products

- Use technical indicators to identify second-wave entry points

댓글 0