통합 검색

통합 검색

- 작성자 관리자

- 조회수 107

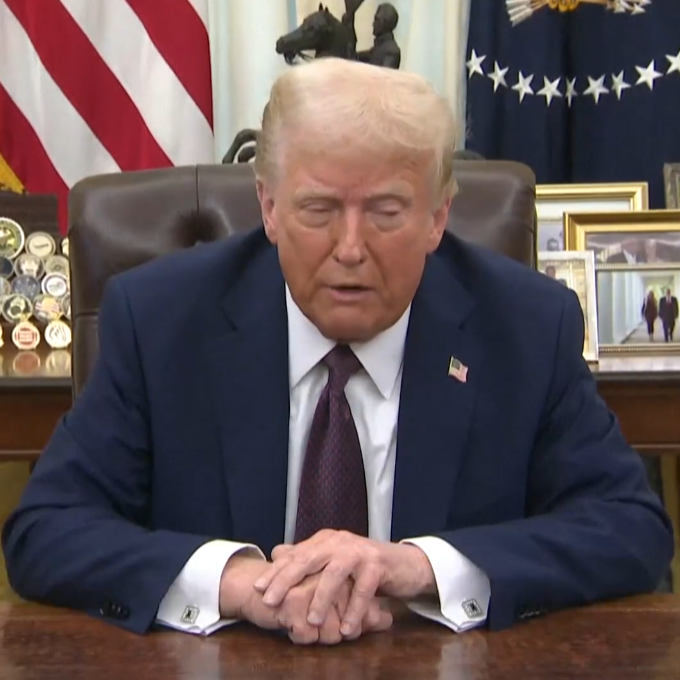

Trump Pressures the Fed for Interest Rate Cuts, Claims He Understands Rates Better Than the Fed

On January 23, 2025, U.S. President Donald Trump expressed his intention to demand interest rate cuts from the Federal Reserve (Fed) during an executive order signing ceremony at the White House. He asserted that he believes he understands interest rates better than Fed officials and stated he would engage in discussions with Federal Reserve Chairman Jerome Powell at an appropriate time. Trump cited inflation control and price stability as reasons for his call for rate cuts. He mentioned, “The inflation rate we inherited is 50% higher than the historical target,” and explained that since taking office, he has taken measures to reverse radical left-wing policies.

He emphasized that lowering interest rates would reduce prices and help alleviate inflation, strongly asserting that rate cuts will happen. Additionally, during a virtual speech at the World Economic Forum (WEF) in Davos, he stated that he would request Saudi Arabia and the Organization of the Petroleum Exporting Countries (OPEC) to lower oil prices. He emphasized that if oil prices drop, interest rates would immediately follow suit. “Globally, interest rates need to be lowered. Rates should follow the U.S.,” he said, expressing confidence that the Fed would respond to his requests. When asked how much he wanted interest rates to drop, Trump replied, “A lot,” and affirmed that he would take a strong stance.

However, despite Trump's push for interest rate cuts, the Federal Reserve continues to maintain its stance on an independent monetary policy, asserting it will not be influenced by political pressure. Experts suggest that, despite Trump’s calls, the likelihood of the Fed accommodating his request is low. Given the economic impacts of interest rate cuts, experts believe it is unlikely that the Fed would adjust rates under political pressure.

Meanwhile, the bond market has remained relatively stable, with minimal fluctuations, and the market's response to the possibility of rate cuts remains calm, despite Trump's ongoing pressure.

댓글 0